Family offices go where wealth goes.

Against a backdrop of significant wealth transfer across Asia, an evolution in wealth management is on the rise. One which is a holistic approach to preserving and growing family legacies in an increasingly complex global economy.

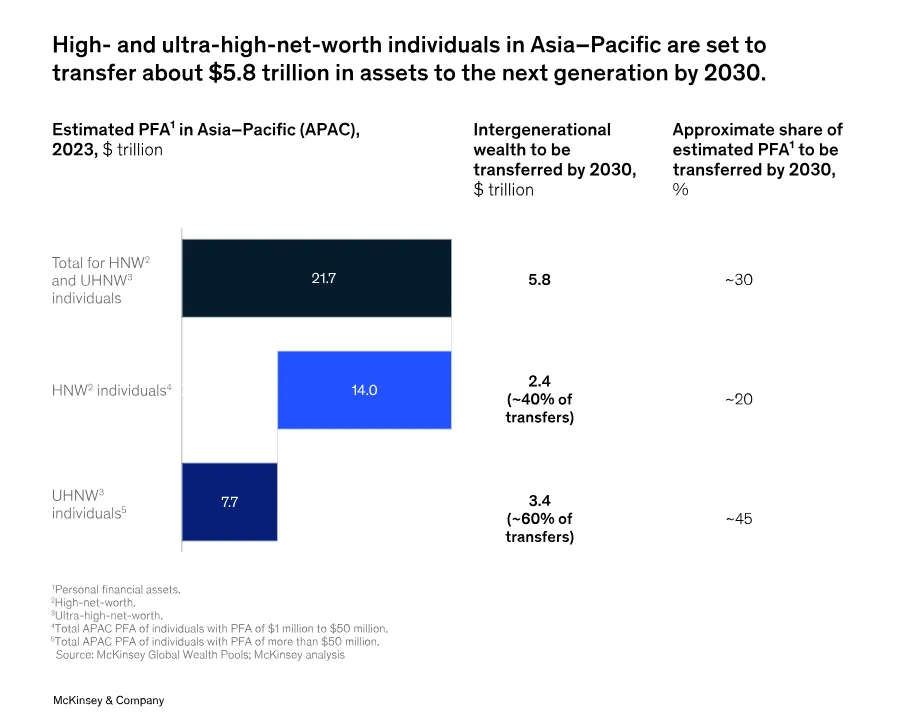

According to McKinsey analysis, between 2023 and 2030, ultra-high-net-worth (UHNWI) and high-net-worth (HNWI) families in the Asia–Pacific region are set to experience an intergenerational wealth transfer estimated at USD5.8 trillion.

Family offices are emerging as the preferred model for UHNWI and HNWI, particularly in Asia. Once dominated by traditional wealth advisory firms, the sector is seeing a shift as families increasingly opt for the tailored, comprehensive services of family offices. This evolution signals not only a strategic change but also a deeper focus on wealth management, legacy, and sustainability.

“Family office” may be a buzzword these days, but the concept is often misunderstood. According to Salil Thanawala, Head of Global Family Office (India), Lighthouse Canton.

“Over the last decade, the term ‘family office’ has often been loosely applied,” he noted.

“Many now use it interchangeably with traditional wealth management, which typically focuses on liquid assets. However, a true family office goes beyond that, offering a structured and sustainable approach to managing not only capital but also legacy, succession, and the personal affairs, and decisions related to operating ventures within the family.”

SUCCESSION AND SUSTAINABILITY

Family offices and wealth advisory firms might seem interchangeable, but the reality is more nuanced.

Wealth advisors typically manage liquid assets—investments, portfolios, and financial products—offering tailored strategies to grow and protect wealth. On the other hand, family offices focus on the entirety of a family's wealth and legacy, encompassing capital management, estate planning, philanthropic goals, and even personal family governance.

Thanawala noted that family offices operate at “three levels above traditional wealth management,” where the conversation is not just about investment products but the broader purpose of wealth. "What is the plan for the family? How is the family making it sustainable? Our focus is not just on wealth preservation but on ensuring the family’s legacy thrives across generations."

While both models oversee capital and assets, a key pillar of a family office’s sustainability is its governance framework. This helps a family to oversee operational and strategic goals while incorporating the aspirations and responsibilities of the family members with respect to the family wealth. Essentially providing a holistic view of wealth that is process-driven and less emotionally entangled.

To achieve this, many family offices start with a family board, consisting of key family members and trusted advisors. This board would also be responsible for drafting a family charter which would guide its mandate.

“The family charter can help provide guidelines on how the family decides on internal conflict, allocation of capital towards business or passion projects and causes.” explained Thanawala

“Ultimately having a good governance framework and process can provide families a clear path to take decisions in difficult situations. These practices can ensure impartiality, and that the family is fair to one another, keeping the family bonded which brings sustainability and stability.” says Thanawala

FAMILY OFFICES: SINGLE, MULTI OR BLENDED APPROACHES

Beyond just wealth management, family offices help provide an institutional level sophistication. A family office provides a structured approach, fostering long-term thinking and strategic planning that extends to financial assets as well as personal relationships and family values.

“A true family office is marked by structured processes. It requires designating qualified people who are accountable for achieving the family office's strategic objectives, and these may or may not be family members” explained Thanawala.

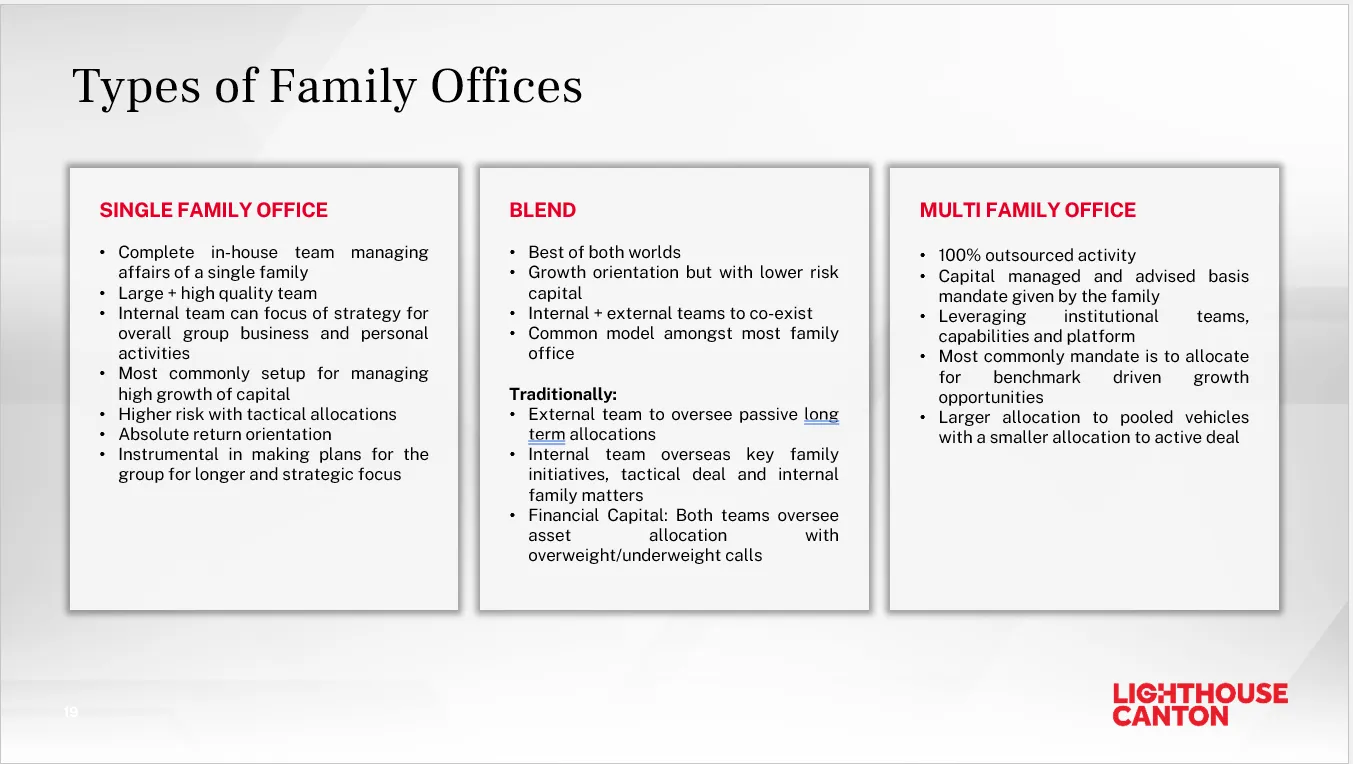

While setting up a family office, families typically consider one of two models - single or multi-family offices. A single family office model typically consists of setting up an entity which comprises an internal team of professionals ranging from investment managers to tax and legal advisors and administrative staff, all who are exclusively dedicated to the one family. On the other hand, in the multi-family office model resources are pooled and families share the services. While the family still retains control over the mandate given to the MFO, families can benefit from a wider range of financial services and broader institutional expertise.

“MFOs provide families with a limited mandate access to institutional expertise without the need to set up a single-family office,” shared Thanawala.

“For these families, it’s an efficient model. They get access to a broad array of services—investment, legal, governance—without the need to have a larger fixed cost, investment and retention of talent,” he added.

“We’re also starting to see blended models - combining some parts of the single family office model and the multi-family office model. This can bring balance and sustainability for a family. For example some families might still want some of that institutional capability, governance and approach to their wealth and succession planning while maintaining control and privacy over their family office. That is when we advise to take a blended model approach.”

A blended approach allows the best of both worlds. It allows one the family to keep internal certain aspects of the family affairs which are private and needed to be kept in-house. While other aspects which can be better managed with external partnerships without having the need to develop that skill set internally.

"We see this in families who, for example, have ventures in philanthropy where they would like to keep the family brand name private. Or say they are investing into businesses that would help the next-generation join the family business and would prefer to keep this under wraps. They would keep these activities in-house. While on the other hand, aspects which are related to liquid capital management which can be easily managed with external partners, they would outsource this to us.” Explained Thanawala

For UHNWI and HNWI seeking a more integrated approach to managing wealth across generations, both blended family office and multi-family office models offer solutions, though with key distinctions.

THE EVOLUTION

The wealth management industry has evolved rapidly over the past few decades. Initially, mutual fund distributors and insurance brokers dominated the landscape. Then came the bank branch model, banks began integrating wealth services with traditional banking products. Today, wealth advisors offer increasingly bespoke solutions, but still, their focus remains primarily on liquid capital and is transactional. The focus tends to be on short-term goals—buying products, making investments, tactical opportunities —with a limited understanding of the broader family dynamics or long-term objectives.

"The thinking and needs of our clients are changing at a fast pace and our engagement also has to evolve to cater to those needs and questions. You can’t just have transactional conversations. To bring sustainability of partnerships between our clients and us, we need to create an ecosystem wherein they are not always second guessing our angle" Thanawala emphasised.

"Wealth management should start by understanding the family’s values and legacy rather than focusing solely on what’s ‘IN’ in the market today."

Family offices, by contrast, have emerged as a more holistic alternative.

As Thanawala explained, “Wealth is generational and family offices are built for partnerships that last decades.”

This reflects a fundamental shift in mindset: family offices aren’t about returns alone; they’re about ensuring wealth is protected, preserved, and passed down with purpose.

THE OUTLOOK

Family offices are expected to continue growing in popularity, particularly in Asia, where wealth is being created at a staggering pace.

According to Knight Frank’s 2023 Wealth Report, Asia will see a 25% increase in UHNWIs by 2027, making it the fastest-growing region for wealth management.

Read Also: Winning together - Lighthouse Canton’s playbook for the fast growing India market

As more UHNWIs across Asia seek comprehensive, sustainable solutions to managing their wealth, family offices will increasingly become the preferred model. The focus on governance, legacy, and personalized service resonates with families seeking not just to protect their wealth but also to preserve their legacy.

Thanawala encapsulated the trend: “At the end of the day, family offices offer direction—how families hold their wealth, how they pass it on, and how they ensure their name and legacy live on.”

.png)

%20(9).webp)

.webp)