Rarely, if ever, will different asset classes align to a single narrative, keeping both bulls and bears in business. “Equilibrium” is a theoretical concept in markets that is constantly disrupted. Probabilistic, rather than deterministic approaches are recommended. Bond markets in particular, will be the key to connecting the disconnects.

Current narrative of a “soft/ no” landing -essentially a steady state in the US economy is disconnected with market expectations of additional 125-150bp rate cuts over the next 12 months. The recent spike in treasury yields is disconnected with expectations of aforesaid rate cuts (although some of this is attributed to the possibility of a Trump administration). The rally in gold, irrespective of whether yields are falling or rising is yet another disconnect. Eventually, these need to resolve with the epicentre being rates at both short-end and long-end of the curve.

For now, we are cautious across the board on risk assets - equities have short-term downside risks, caution on bond duration and limited case for incremental bullishness on gold. To revive bullishness on equities, policy continuity (post US elections) and defending 5650-5700 on SPX will be critical. For bonds (especially duration) and gold, growth weakness will be positive signs.

source: Lighthouse Canton

- Equities – There are short-term risks to equities led by elevated election uncertainty - our model portfolio has added hedges progressively over the past week. The growth outlook however remains supported by a steady economy and earnings delivery. Defending 5650-5700 on SPX, will be critical to retain the positive outlook. While the case for equities is helped by FED rate cuts, between growth and rate cuts, we see the former as the necessary variable given that borrowing decisions tend to more pro-cyclical than evident on first glance. The risk to a positive view on equities, in particular growth equities, comes from missed growth expectations - either more broadly at the economy level or specifically at the corporate level. As such, the biggest risk for equities will probably stem from a weaker than currently expected economy and while that will likely be accompanied by sharper rate cuts, growth will take precedence.

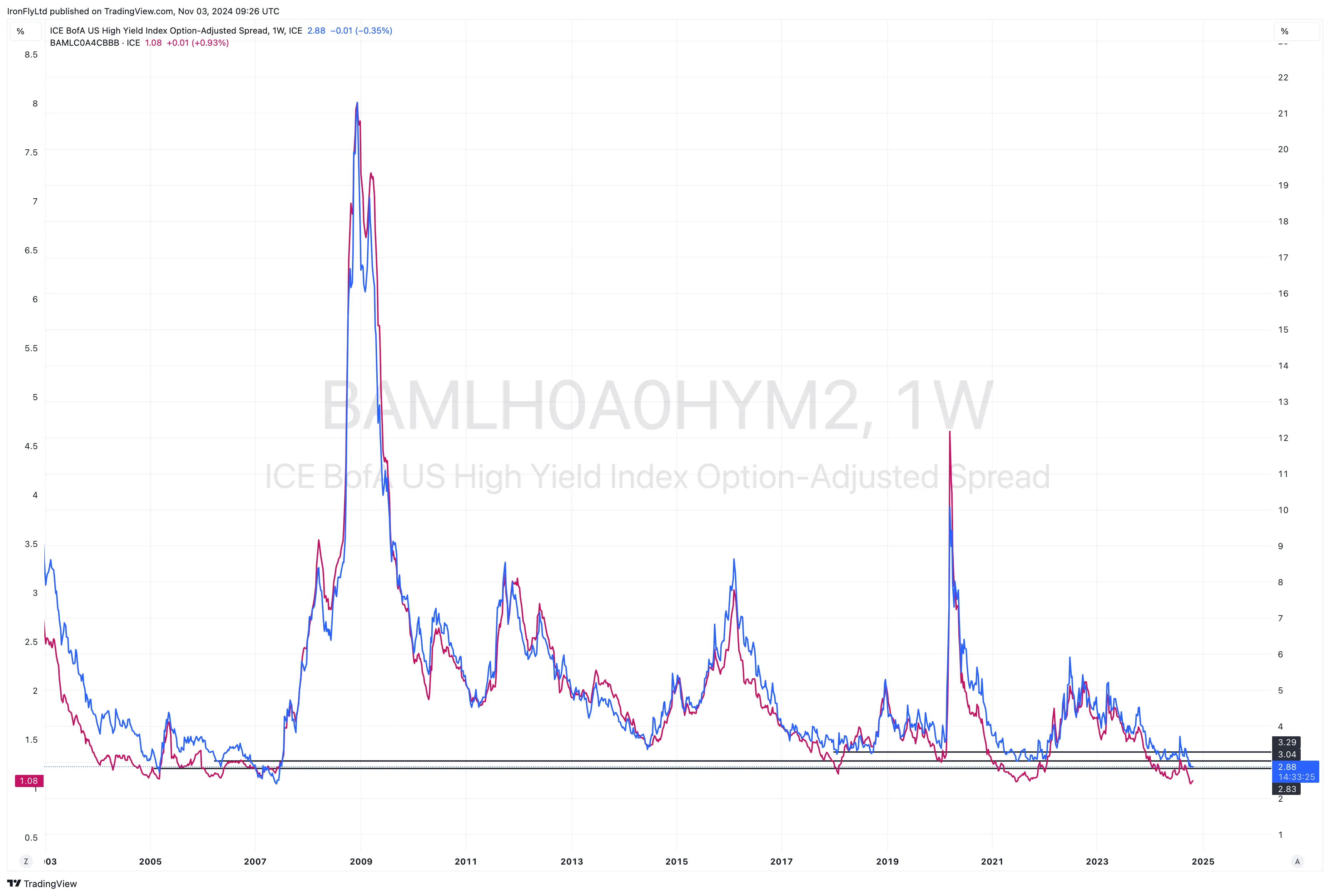

- Bonds - With credit spreads near record lows (across the investment grade and high yield spectrum), the case for being long bonds, particularly duration, rests on the basis. With a base case of a steady economy, not only is the case for aggressive rate cuts weakened, but so is the case for treasury yields coming off materially. As such, our base case for bonds is to keep duration in check and not materially exceeding 5 years. The risk to this view comes from a weaker than currently expected economy.

- Gold - The rally in gold, spurred by both central bank buying (albeit eased in recent quarters) as well as the commencement of a rate cutting cycle, begs the question on incremental drivers from hereon. A steady economic backdrop does not argue well for aggressive rate cuts as previously noted and is thus the biggest risk to incremental bullishness on gold.

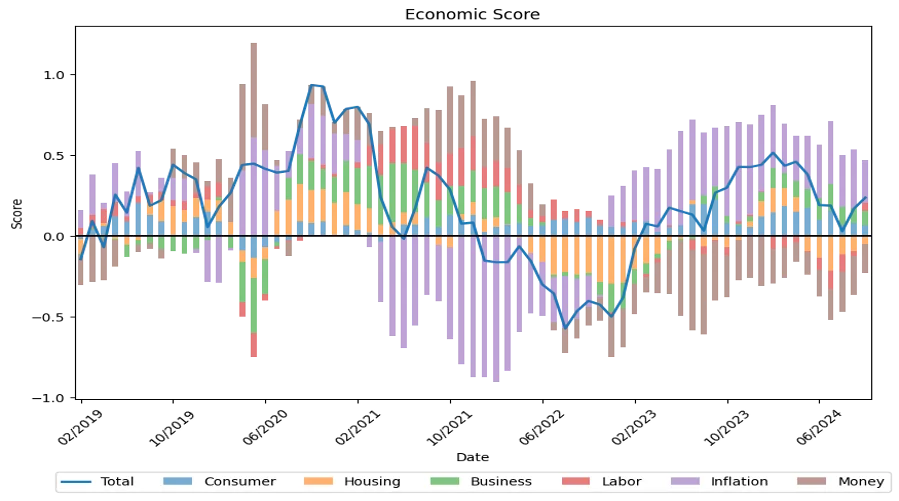

Economic Nowcaster

Our proprietary economic nowcaster shows a modest recovery after a decline in 3Q with the Revival led by consumer, labor and inflation markers. Even within each macro category, trends are muddled, consistent with an economy in transition with a downshift bias. However, the aggregate picture is of steadiness rather than a sharp retrenchment, at least for now.

source: Lighthouse Canton

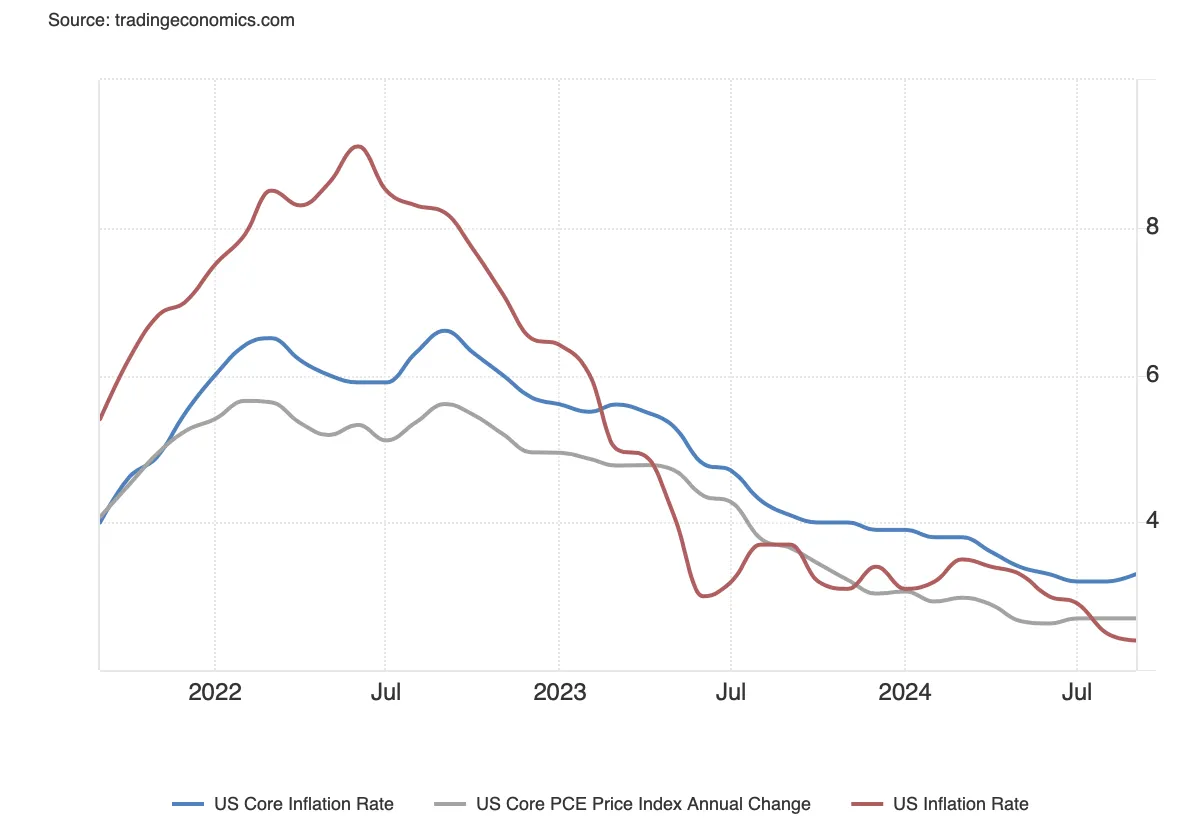

Interest Rates, FED Decisions, Inflation and Bond Yields

Following the 50bp rate cut in Sep'24, expectations of aggressive rate cuts over the next 12 months remain in place, albeit these expectations have moderated materially in recent weeks. While a 25bp rate cut (Nov'24) appears highly likely (99% probability), the path post Nov'24 will depend on data - given current trends, whether the FED needs to cut by a cumulative 175-200bp over the next 12 months needs to be questioned. While inflation metrics continue to trend down, any spikes, led either by premature easing or supply side constraints (tariffs, oil prices) will add to the uncertainty of aggressive rate cuts.

For bonds, especially longer-duration, we need to see either further spread compression and/or reversal down in treasury yields. With credit spreads near historic lows, we see the case for extending bond duration largely dependent on the trajectory in underlying treasury yields, and in turn on the FED path. Given current growth markers, an aggressive extension of duration is not warranted.

FED Fund Futures Implied Rates (Dec'25) and Probabilities

Inflation - al markers continue to trend down, for now

Credit Spreads Near Historic Lows

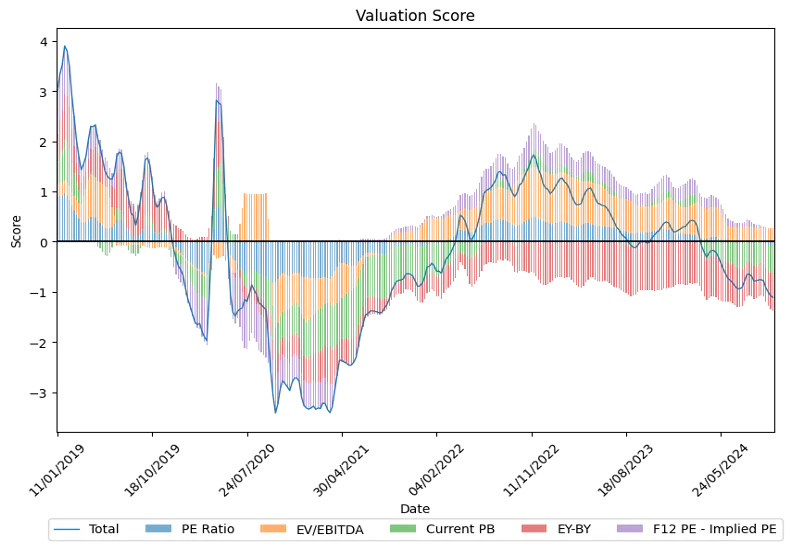

Earnings & Valuations

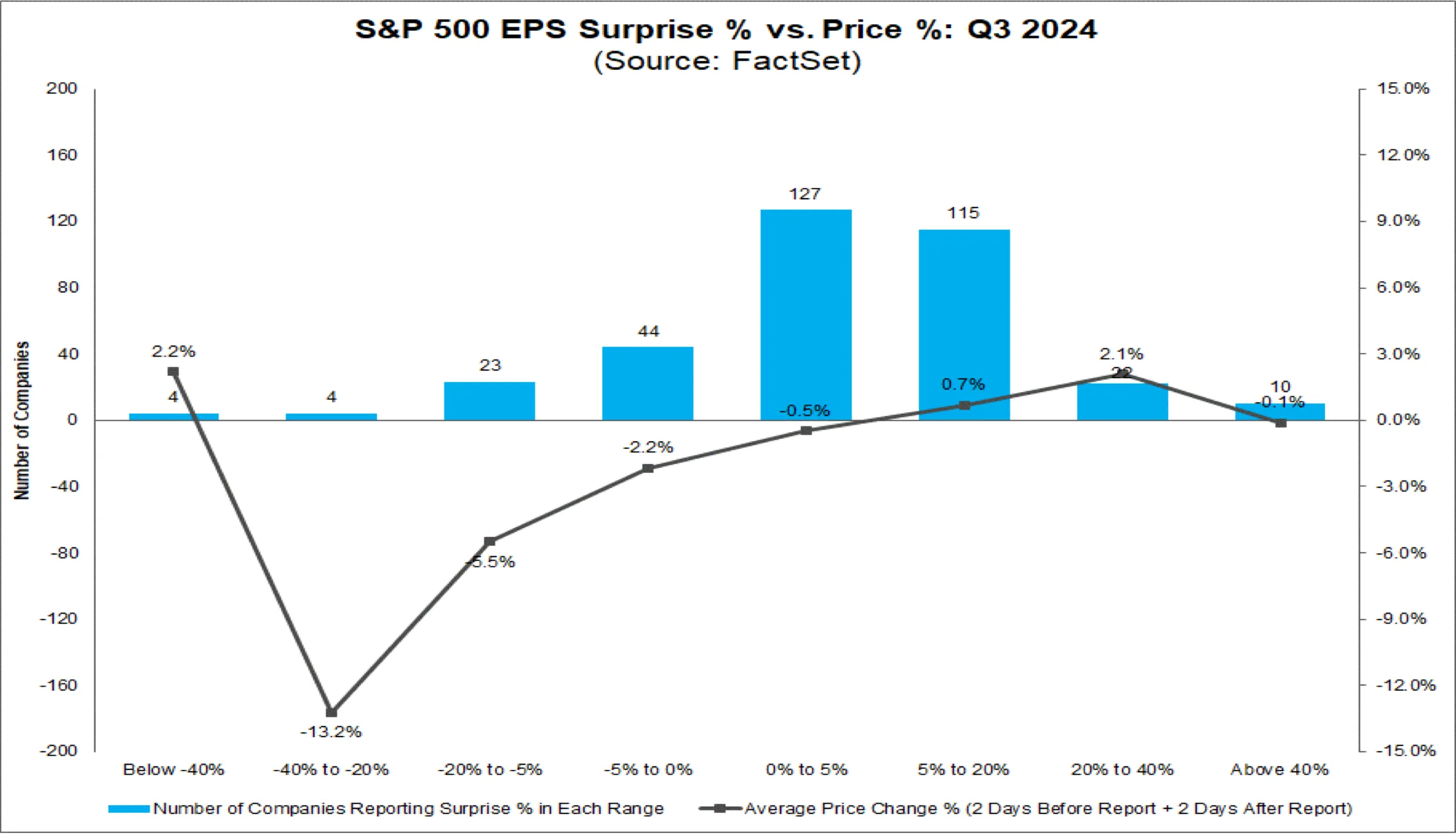

3Q'24 earnings season continues to beat what were moderate expectations, although scale of surprise is below historic averages. Importantly, we continue to see a negative skew on price reaction post earnings, consistent with the trend seen in 1Q and 2Q, suggesting a high bar for earnings and guidance delivery. This assumes even more importance in the context of consensus 12.7% EPS growth for 4Q and c15% for 2025.

Both equity and bond valuations (as measured by credit spreads) remain expensive in a historic context. For equities, these have thus far been supported by earnings delivery, once again highlighting the importance of delivering and beating current growth expectations.

source: Factset

source: Lighthouse Canton

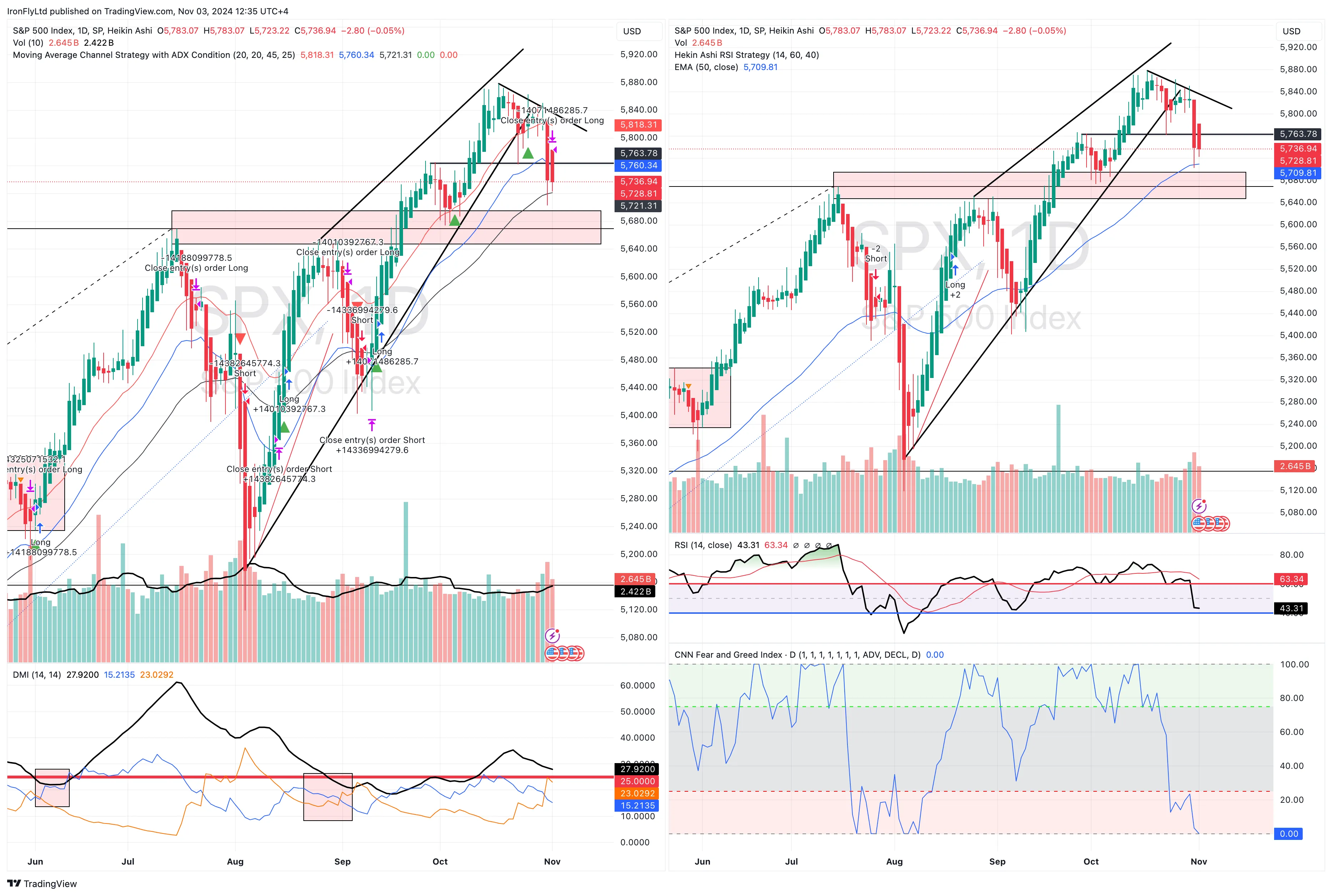

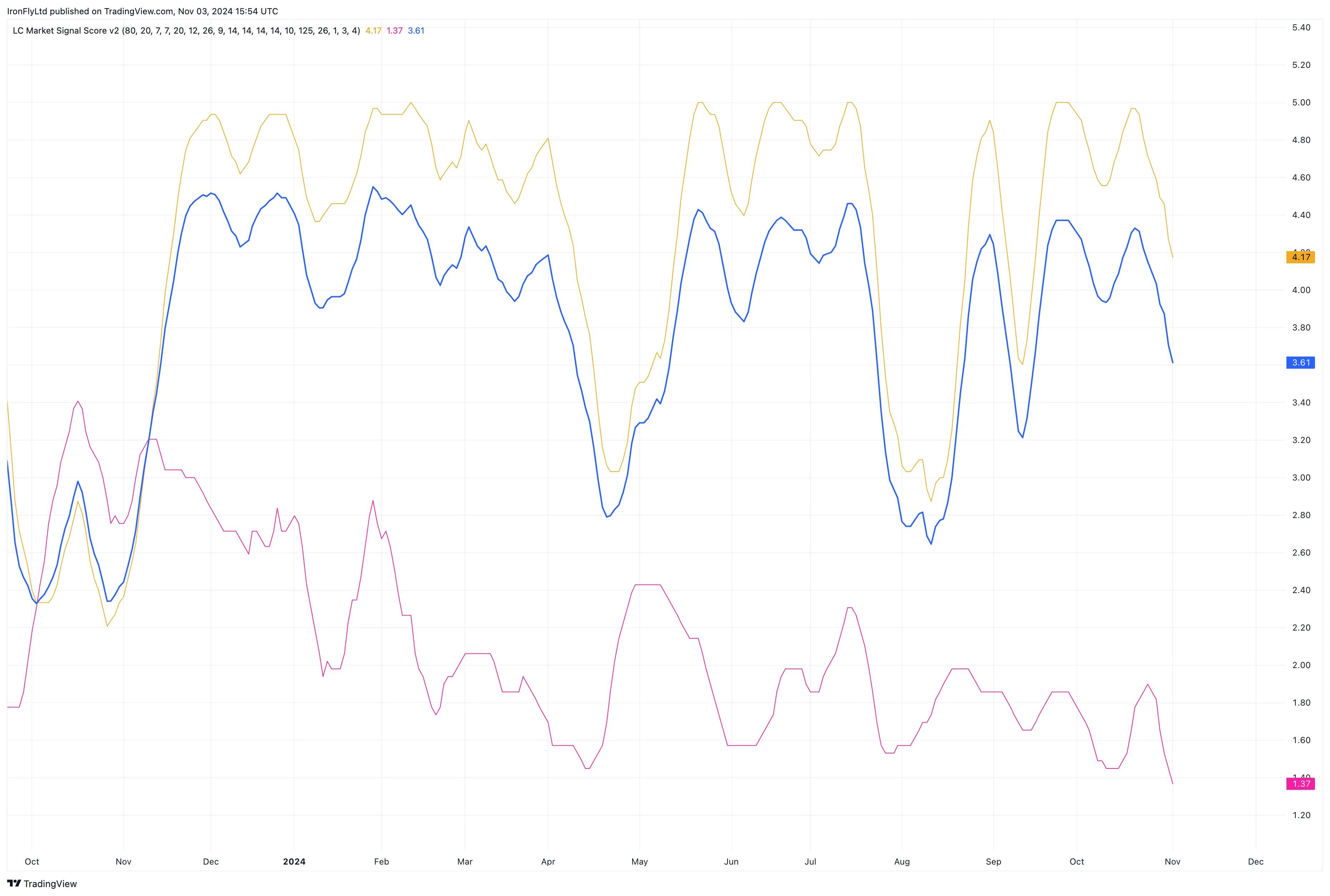

Market Signals

Our market signals model has seen a deterioration - both trend and oscillator scores and following a "close long positions" signal, we have progressively added hedges to our model portfolio. Sentiment is middling although on a normalized basis, has retrenched substantially but not reviving just as yet. Breadth has also retreated and we are yet to see a reversal up. Importantly, with growth equities, especially tech, struggling, the near-term outlook is cautious.

SPX is currently close to testing key support levels (5650-5700) and defending these levels will be critical in retaining a positive bias.

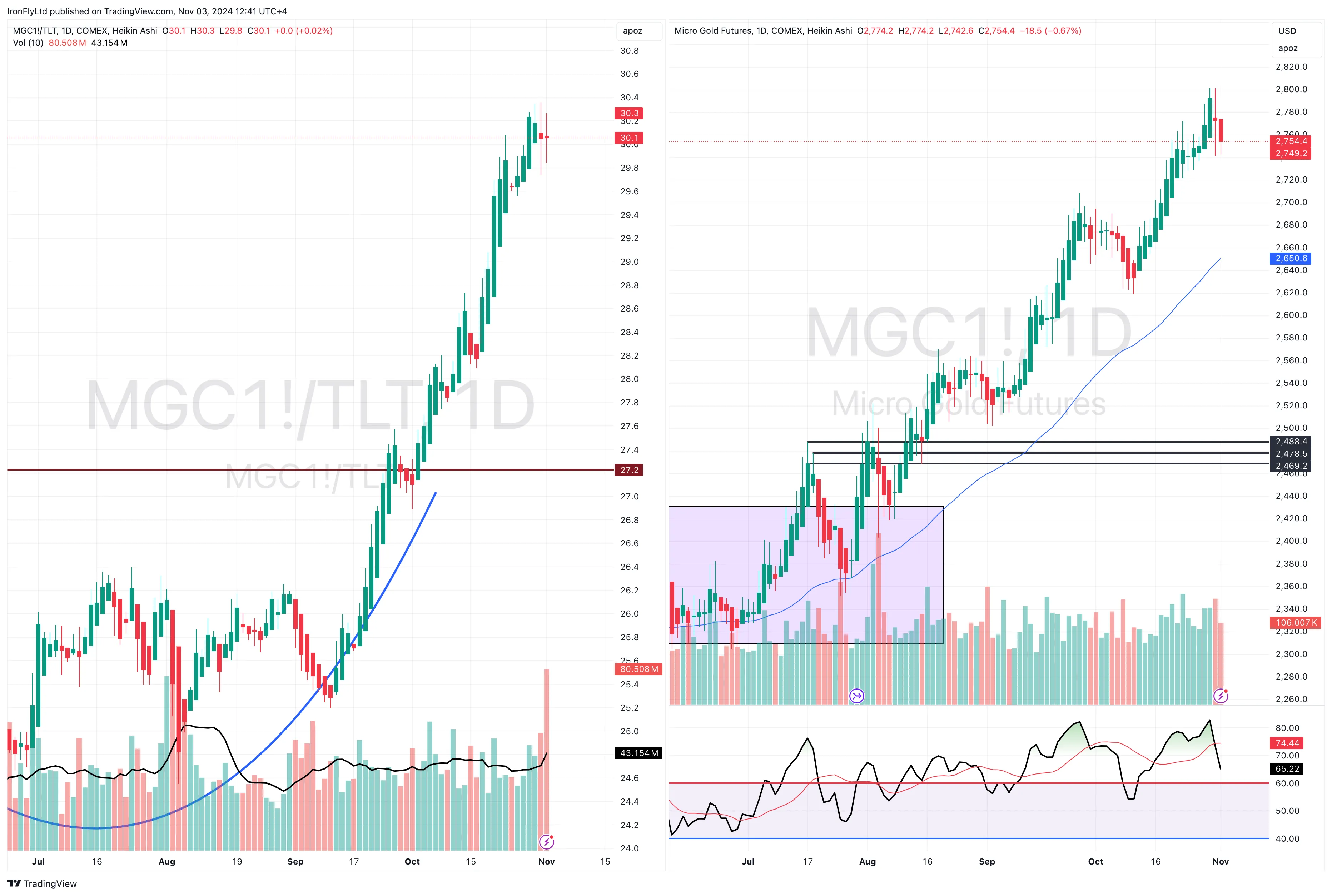

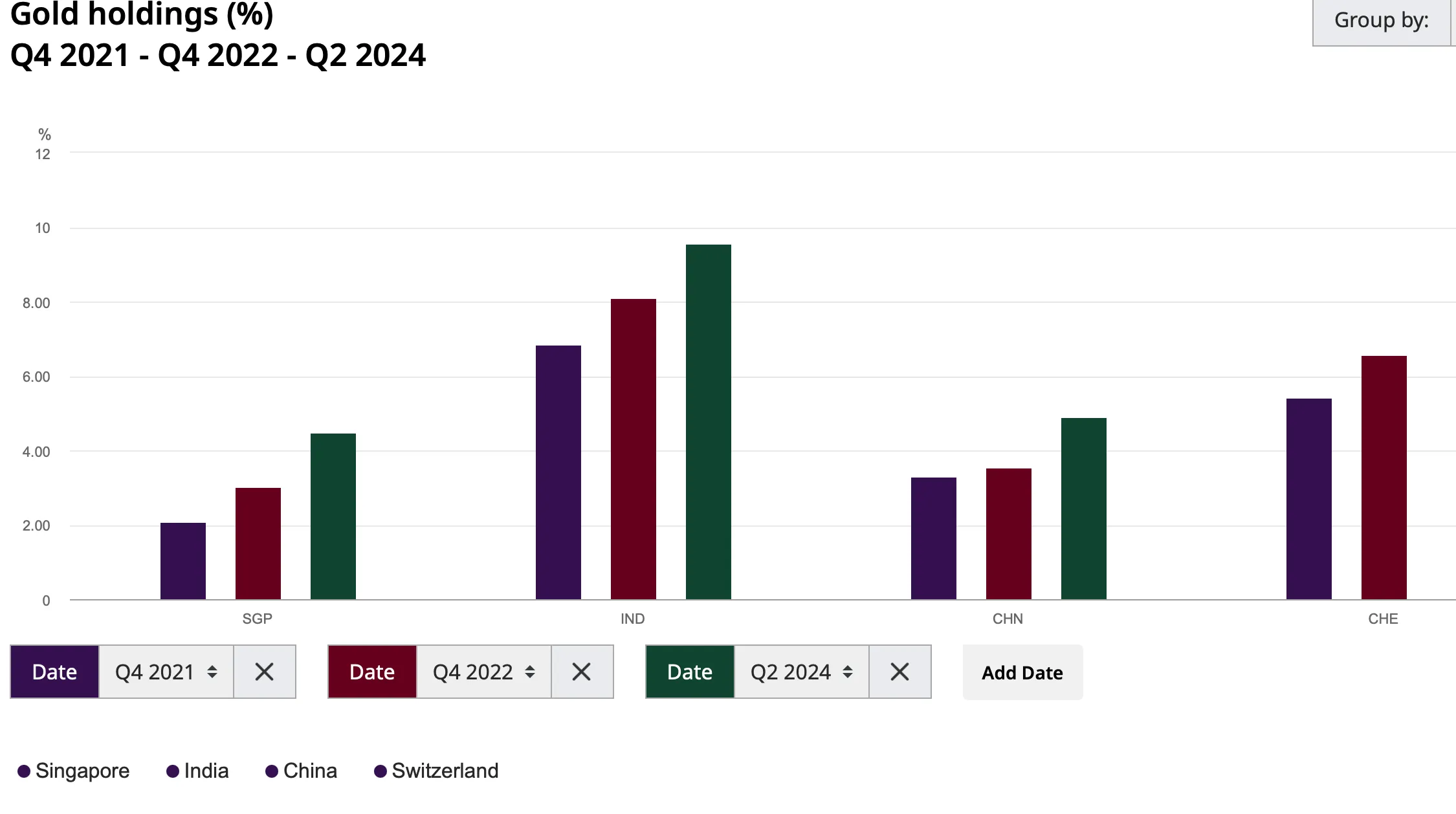

Gold - Caution near Term?

The rally in gold appears to be flagging for now - both in absolute terms and relative to bonds. While we have been positive on gold - absolute and relative to bonds, the key question is whether there is incremental reasons to be bullish in the near-term, especially with the uncertainty surrounding the path of monetary easing.

We should also note that while central banks' increased allocation to gold has been an important driver for gold prices, these trends appear to have eased in recent quarters.

source: World Gold Council

All investments carry risk, for more important information please read this disclaimer.

.jpg)

%20(29).jpg)

%20(27).jpg)