Equities and Bitcoin are cheering while bonds and China equities are retreating, following the now near certainty of a Republican sweep. Will this last? We believe the promise of a growth environment, lower taxes is driving positive sentiment, especially given the track record of Mr. Trump's previous term (2016-2020). We however note that 2024 is not 2016 - the fiscal headroom for expansionary policies is far more limited (see below) and the threat of tariffs is not just inflationary, but also a growth headwind.

In the face of a "steady" economy, we have questioned the market's exuberance in expecting an aggressive monetary easing path. This question now becomes even more pertinent in view of potential inflationary pressures brought about by the incoming administration's fiscal profligacy and approach to trade tariffs.

Notwithstanding the short-term market reactions, we see macro risks to equities. While price action will lead, our bias is to fade the rally in equities. For bonds, risks remain skewed to the downside, albeit a substantial part of the "Trump Trade" may already have been priced in. Long opportunities on bonds, especially duration, will arise, not just today. Our hitherto bullish view on China, premised on domestic recovery and exports is now partially under threat. While we continue to see domestic consumption and tech sectors as attractive, exports are likely to see a headwind from potential tariffs.

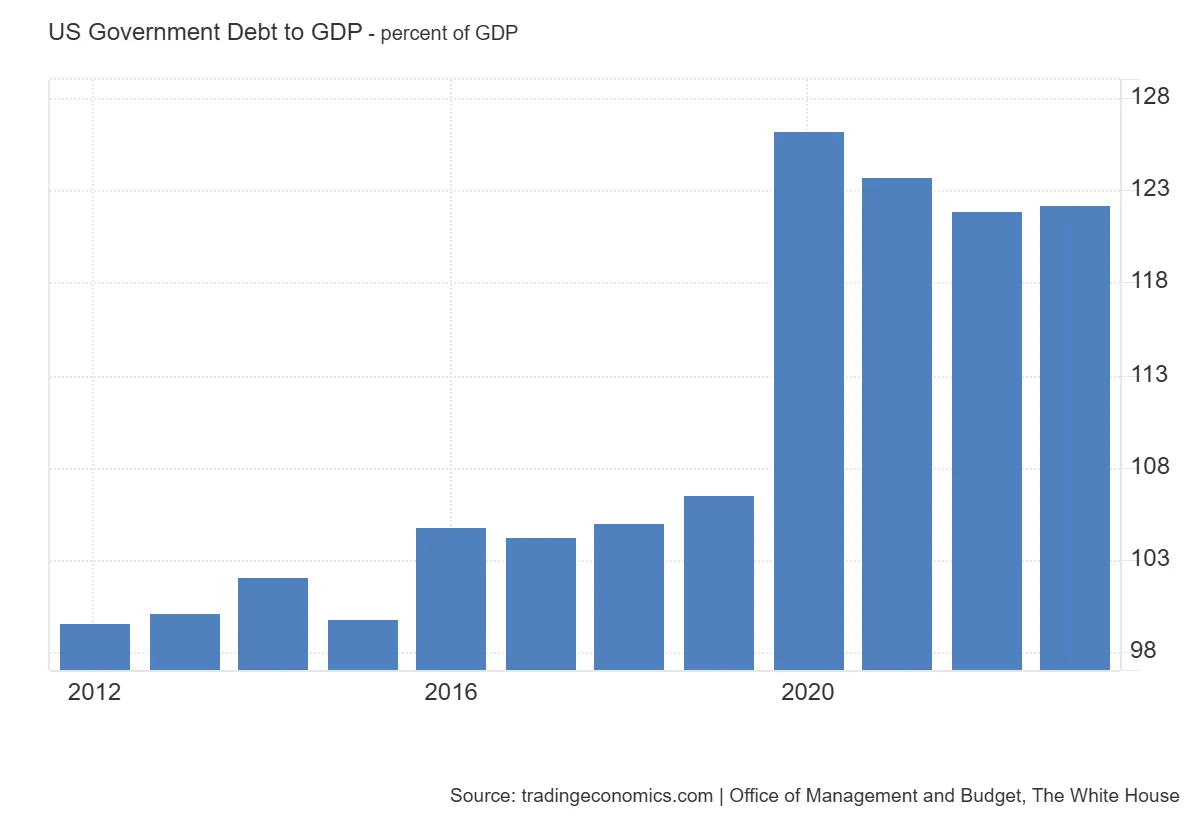

- Fiscal Limitations to Growth? - Government debt to GDP at 123% is substantially higher than the 105% in 2016, potentially limiting the fiscal expansion

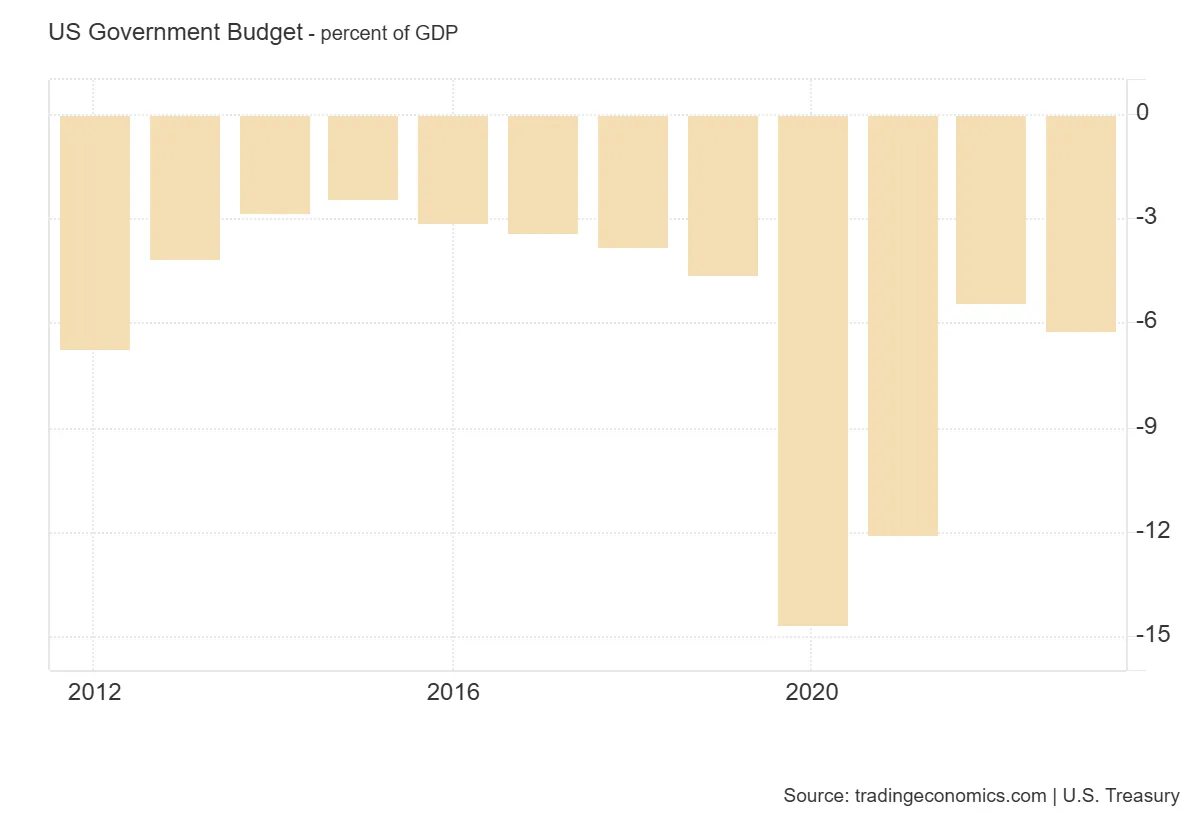

- Budget Deficit Limitations to Tax Cuts - At 3.1% in 2016, the deficit was far more manageable as compared to current levels of over 6%, limiting the headroom for additional fiscal expansion. While we appreciate the argument that higher tariffs will pay for tax cuts, the negative impact on inflation and growth, resulting from tariffs, may make this equation somewhat difficult to deliver on.

All investments carry risk, for more important information please read this disclaimer.

No items found.

SOME SUGGESTION

View All

.png)

%20(9).webp)

.webp)